Debt can feel like a heavy backpack you carry everywhere you go. Every time you think about taking a break or indulging in something nice, there’s that nagging reminder: “I can’t, because I have debt.” But what if I told you that with a few strategic moves—what we’re calling “Debt Demolition”—you could free up thousands of dollars faster than you ever imagined?

In this blog post, we’ll break down the most impactful methods (the Debt Snowball and Debt Avalanche), share actionable steps to turbocharge your progress, and even compare these strategies side by side in an easy-to-scan table. By the end, you’ll have a clear plan to smash through your balances and reclaim your financial freedom.

Understanding the Debt Trap

Ever feel like you’re stuck in quicksand when it comes to debt? No matter how much you throw at it, interest keeps pulling you back. That’s the hallmark of a debt trap. Essentially, a debt trap occurs when high-interest payments and minimum obligations keep you bound to a cycle of borrowing and paying interest, making it nearly impossible to make meaningful progress toward full repayment.

How the Debt Trap Works

Imagine you have two credit cards—one with a $5,000 balance at 20% APR, and the other with a $2,000 balance at 18% APR. You diligently pay the minimum each month, perhaps $150 on the first and $60 on the second. But here’s the catch: your minimum payments mostly cover interest. Only a tiny sliver chips away at the principal. So, even if you dutifully pay $210 total, your balances barely budge. If you slip up—say, you can only afford $180 one month—late fees and penalty APRs kick in, pushing you deeper into the trap.

A debt trap is a vicious cycle where rising balances, fees, and high interest rates conspire to keep you owing more than you can pay off. That’s how many experts describe the experience—and why it’s so important to break free before interest piles up.

See: Credit Unions – Bankrate

In other words, without a proactive plan, you’ll never actually escape. That’s where debt demolition comes in: an intentional, focused approach to free up thousands by attacking your balances strategically.

The Global Debt Trap Dialogue: “Debt Trap Diplomacy”

You may have heard the term debt trap diplomacy bandied about in news headlines, especially when discussing China’s lending practices worldwide. While that phrase primarily refers to international finance, there’s a surprising parallel to personal debt: both involve situations where debt becomes a tool of leverage and constraint.

What Is Debt Trap Diplomacy?

In geopolitical terms, Debt Trap Diplomacy describes a strategy where a powerful creditor extends loans to governments or entities, intending to secure economic or political concessions once those loans become difficult to repay. For example, a country might borrow billions for infrastructure projects—railways, ports, roads—only to discover that revenues don’t cover repayment. Suddenly, the borrower finds itself negotiating from a position of weakness, forced to concede strategic assets or favourable trade terms.

Why It Matters

While you’re not likely to be negotiating port leases or mineral rights, the principle remains: when debt grows beyond your capacity to repay, you become beholden to creditors. They can impose higher interest rates, insist on stricter repayment plans, or even threaten legal action. Just as a nation stuck in debt diplomacy loses autonomy, individuals trapped in high-interest credit card debt or payday loans lose financial flexibility. Recognising this parallel is important; it underscores the urgency of taking control before your own “creditors” start dictating terms.

Spotlight on the Chinese Debt Trap

The phrase “Chinese debt trap often surfaces in discussions about China’s Belt and Road Initiative (BRI). Critics claim China extends loans to developing nations under terms that appear generous at first but become onerous when repayment deadlines loom. When borrowers can’t meet those deadlines, the argument goes, China gains leverage—sometimes access to ports, resources, or political influence.

Fact vs. Fiction

Despite sensational headlines, some analysts argue that the “Chinese debt trap” narrative is overstated. A February 2021 article in The Atlantic, “The Chinese ‘Debt Trap’ Is a Myth”, highlights that Chinese lenders have restructured loans, written off debts, and rarely seized assets outright. Still, there’s no denying that in countries like Sri Lanka and Djibouti, reliance on Chinese loans has led to significant repayment burdens. For instance, Sri Lanka’s Hambantota Port—funded by China’s Exim Bank at a 6.3% interest rate—became such a financial drain that the government signed a 99-year lease with China Merchants Port for $1.12 billion to service other debts. Wikipedia on the Sri Lankan economic crisis.

While the mechanisms differ, the lesson is clear: be wary of “too good to be true” loan terms. Whether you’re a nation building a new port or an individual funding a wedding with high-interest credit, always consider long-term repayment capacity.

Key Steps for Personal Debt Demolition

Now that we’ve framed the broader context, let’s zero in on how you can demolish your debt and free up thousands. These steps rely on discipline, consistency, and a willingness to make temporary sacrifices for long-term gain.

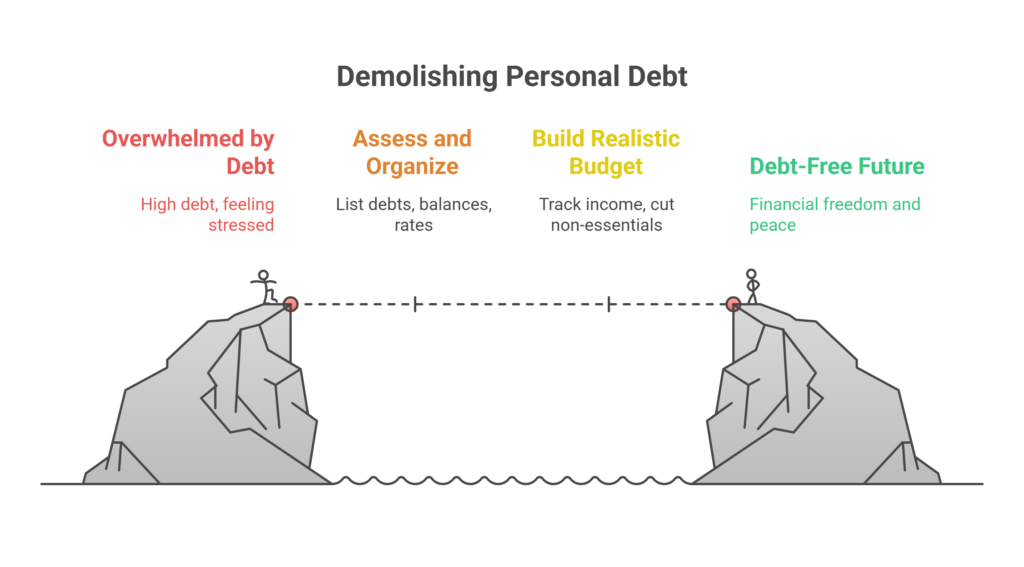

1. Assess and Organise Your Debt

You can’t fight what you can’t see. Before diving into repayment, create a comprehensive snapshot:

- List every debt: credit cards, personal loans, car loans, student loans, medical bills—everything.

- Record balances: current outstanding balance for each.

- Note interest rates: APRs or interest percentages.

- Track minimum payments: the least you must pay each billing cycle.

A simple spreadsheet works wonders here. If you prefer an online tool, consider the free debt planner at Undebt. It generates a repayment schedule once you plug in balances and rates. The goal is clarity: you should be able to glance at your list and know exactly where you stand.

2. Build a Realistic Budget

Once you know what you owe, it’s time to see how much you can reasonably devote to repayment. This involves:

- Tracking income and expenses: Use an app like Mint, YNAB (You Need A Budget), or even a notepad.

- Categorizing spending: Divide expenses into essentials (rent, groceries, utilities) and non-essentials (dining out, subscriptions, entertainment).

- Identifying quick wins: Cancel unused streaming services, negotiate lower cable or phone bills, and trim subscription boxes you forgot you had.

According to Investopedia, a rule of thumb is the 50/30/20 budget: 50% of income to needs, 30% to wants, and 20% to savings/debt. During an aggressive debt demolition, you might temporarily shift to 60/20/20—more toward needs and debt, less toward wants.

Tips for Sticking to Your Budget

- Automate savings: Set up an auto-transfer of a fixed amount each payday into a “Debt Slayer” account.

- Use cash or debit: When possible, avoid credit cards—once plastic is out of sight, overspending stops.

- Review weekly: A glance at transactions every Sunday helps catch leaks before they grow.

3. Cut Expenses Aggressively

Here’s where you might have to get creative. Every dollar you don’t spend on extras is a dollar you can fling at your debt. Consider:

- Meal prepping: Cook in bulk instead of grabbing takeout. A $10 restaurant meal might cost $3–$4 to replicate at home.

- Downgrading: Switch to a cheaper phone plan, downsize your cable package, or use free streaming alternatives (like network apps or library e-books).

- Rethinking transportation: Can you bike, take public transit, or carpool? Even cutting one fill-up per week saves money.

- Pausing non-essential subscriptions: Gym membership? Magazine subscriptions? Pause them until you’re debt-free.

A practical example: If you spend $150 monthly on streaming and can cut it down to $30 (keeping just one essential service), that frees $120/month—$1,440/year—to smash through your balances. Multiply these small cuts across groceries, utilities, and discretionary purchases, and you’ll be amazed how fast it adds up.

4. Stop Accumulating New Debt

This sounds obvious, but it’s a pitfall for many. If you continue to swipe credit cards for dinners out while paying them down, your progress stalls. To truly demolish debt:

- Freeze credit cards: Temporarily remove saved card numbers from apps like Amazon and your phone’s wallet.

- Consider a debit-only policy: Only use what you have in checking or savings.

- Build an emergency fund: Even $500–$1,000 in a high-yield savings account stops you from relying on credit for unexpected expenses.

Experts at Navy Federal argue that breaking the habit is as important as having a plan. Once you stop the inflow of new debt, your existing balances won’t keep climbing. It’s a psychological and financial reset.

5. Increase Your Income

Sometimes, cutting expenses isn’t enough—you need to boost your inflow. Consider:

- Side gigs: Rideshare driving, food delivery, or freelancing skills on platforms like Upwork or Fiverr.

- Part-time work: A weekend job in retail, tutoring, or hospitality. Even 10 extra hours a week can make a big dent in small balances.

- Selling unused items: Garage sales, eBay, Poshmark, Mercari—clothes, electronics, books. Those unused baby items or old gadgets could be $100–$200 in your pocket.

- Monetizing hobbies: If you bake, sell cookies. If you craft, list items on Etsy.

Every additional dollar you earn should be funnelled into debt repayment. If you receive a tax refund or year-end bonus, earmark 100% of it for your “Debt Slayer” fund.

Choosing the Right Debt Repayment Strategy

Once you’ve tightened up your budget, cut costs, and started directing extra cash toward debt, you need to decide how to apply that “extra.” Two of the most popular methods are the Debt Snowball and the Debt Avalanche. While both aim to accelerate your repayment, they do so in slightly different ways.

How the Debt Snowball Method Works

- List debts from smallest balance to largest: Ignore interest rates initially.

- Pay minimums on all debts except the smallest: Put every extra dollar into that smallest debt.

- Celebrate the win: When the smallest debt is paid off, “snowball” its payment amount into the next smallest balance.

- Repeat until all debts are gone.

The magic of the snowball lies in the psychology. Knocking out a $300 balance in month one feels incredible. That emotional boost motivates you to keep going. According to Investopedia, though you might pay slightly more in interest overall, the quick wins often keep people on track.

How the Debt Avalanche Method Works

- List debts by highest interest rate first and note the APR for each.

- Pay minimums on all debts, but channel extra funds to the highest-APR debt.

- Once that high-interest debt is paid, move to the next highest APR.

- Continue until all debts are gone.

By focusing on interest, the Avalanche method minimizes the total amount you pay over time. For instance, if you have a credit card at 22% APR and a student loan at 4%, the Avalanche tells you to tackle the 22% first—even if that balance is larger. Investopedia’s comparison shows that you could save hundreds or even thousands by following this approach.

Debt Snowball vs. Debt Avalanche: At a Glance

| Method | Priority | Main Benefit | Drawback |

| Debt Snowball | Smallest balance first | It may take longer to see the first debt fully paid off | Can result in paying more interest over the long haul |

| Debt Avalanche | Highest interest rate first | Saves the most money on interest over time | May take longer to see the first debt fully paid off |

Which Method Is Fastest?

- Debt Avalanche usually wins the “fastest in total dollars saved” contest. If you’re disciplined and not discouraged by slower initial progress, your wallet will thank you.

- Debt Snowball tends to be the fastest at “quickening the pace of motivation.” Those smaller slices disappearing can keep you engaged, especially if you’ve been stuck in debt for years.

Ultimately, the fastest method is the one you stick with. Studies, including a JMU Scholarly Commons analysis, confirm that Avalanche is mathematically ideal, but Snowball can be psychologically superior. Choose based on your personality: if seeing progress early keeps you going, snowball away. If saving the most interest is your goal, avalanche ahead.

Additional Tactics to Accelerate Debt Elimination

Beyond picking your preferred repayment strategy and shoring up your monthly budget, there are more levers to pull:

1. Negotiate with Creditors

- Request lower interest rates: If you’ve been a reliable payer for at least six months, call your credit card issuer and politely ask for a rate reduction. You might be surprised—some customers score cuts from 18% to 12% simply by asking.

- Ask for hardship programs: Many lenders have temporary hardship plans that reduce your interest or waive late fees.

- Balance transfers: If you have good credit, you could move a high-APR balance to a 0% APR card for 12–18 months. But, watch out for transfer fees (typically 3–5% of the balance), and have a solid plan to clear it before the promotional period ends.

According to MoneyTips, just a 3% rate drop on a $10,000 credit card balance can shave hundreds off your total interest.

2. Consider Consolidation or Refinancing

- Personal loans: If you can qualify for a lower-rate personal loan (e.g., 8% APR vs. 20% APR on credit cards), you can bundle multiple credit card balances into one loan. Monthly payments often become lower, and the term length is predictable.

- Home equity loans or HELOCs: If you own a home, borrowing against equity can often yield a single-digit interest rate. But tread carefully—your home becomes collateral. If you default, you risk foreclosure.

Before consolidating, run the numbers. NerdWallet has a great calculator that shows you total interest savings for different scenarios.

3. Seek Professional Help if Needed

Sometimes, the overwhelm hits hard, and DIY tactics aren’t enough. Consider:

- Nonprofit credit counselling: Agencies like the National Foundation for Credit Counselling NFCC offer free or low-cost guidance. Counsellors can review your situation, suggest a budget, and even negotiate with creditors on your behalf.

- Debt management plans (DMPs): Under a DMP, you deposit money each month with a credit counselling agency, which pays your unsecured debts (credit cards) under a plan that may reduce interest rates or waive fees. Expect to commit 3–5 years; on the plus side, you’ll make one monthly payment rather than juggling multiple creditors.

- Bankruptcy: This is a serious step with long-term credit implications. If you’re so far underwater that your debts exceed your ability to ever repay (and you can’t secure relief through negotiation), consult a bankruptcy attorney. Chapter 7 or Chapter 13 can wipe out or reorganise debts, but your credit score will take a major hit for years.

Sources like ConsumerCredit note that counselling and DMPs often make sense before considering bankruptcy. It’s always wise to explore all other options first.

The Role of Emergency Funds and Sinking Funds

One of the biggest obstacles to staying out of debt is unexpected expenses—car repairs, medical bills, or sudden job loss. Even if you’re making solid progress, one crisis can send you back to square one. Here’s how to build buffers:

1. Emergency Fund (Primary Defence)

- Target: $500–$1,000 initially, then grow to 3–6 months of living expenses.

- Why: According to a Self.com guide, having a small emergency fund stops you from reverting to credit cards for minor emergencies.

- How: Start with $10–$20 per paycheck, even if it means stretching a bit on groceries for a month.

2. Sinking Funds (Anticipated Costs)

- Definition: Money set aside for predictable, intermittent expenses (e.g., car registration, holiday gifts, annual subscriptions).

- Implementation: If car insurance is $600/year, save $50/month in a separate category. When the bill arrives, you pay cash instead of charging it.

- Benefit: Prevents seasonal or annual costs from derailing your budget.

By protecting yourself against both unplanned and planned expenses, you ensure that your debt demolition stays on track—one setback won’t spiral into renewed borrowing.

Key Takeaways: The Building Blocks of Debt Demolition

- Clarity First: List every debt, note balances, rates, and minimums.

- Budget Like a Boss: Track every rupee. Cut at least 10–20% of discretionary spending.

- Accelerate with Extra Income: Side gigs, freelance work, or selling unused items can add hundreds or thousands to your debt-slashing arsenal.

- Choose a Strategy (and Stick with It):

- Debt Snowball: Best if you need psychological wins.

- Debt Avalanche: Best if you want to save the most in interest.

- Debt Snowball: Best if you need psychological wins.

- Negotiate and Consolidate: Reach out to creditors for lower rates. Explore consolidation if it reduces your interest burden.

- Protect Your Progress: Maintain a small emergency fund and sinking funds to avoid new debt traps.

Stay Disciplined: Automate payments, celebrate each balance wiped out, and keep your eyes on the prize—complete financial freedom.

Why the Wealth Gap is Growing and How a Common Man Can Break Free

Frequently Asked Questions

What if I can’t decide between Snowball and Avalanche?

Try Snowball if you need quick wins to stay motivated. Choose Avalanche if you want to save more on interest. You can even switch between them based on your mindset.

How long will it take to become debt-free?

It depends on your total debt, interest rates, and how much extra you can pay. For example, $20,000 at 18% APR with $500 extra/month could be paid off in 4–5 years using Avalanche.

Is a balance transfer credit card worth it?

Yes, if you have good credit, you can get a 0% APR offer, and plan to pay it off within the promo period. Watch out for transfer fees and post-promo interest rates.

Should I focus on debt or retirement savings?

Pay off high-interest debt first. For lower-interest debt, you can save a little for retirement (especially if your employer matches) while repaying debt.