We’ve all been there: Your car sputters to a stop. Your roof springs a leak. Or worse, your job vanishes overnight. These aren’t hypotheticals; they’re real-life financial earthquakes. Yet 43% of Americans can’t cover a $1,000 emergency. If that statistic makes you sweat, you’re not alone.

The good news? Building an emergency fund isn’t just for finance gurus. It’s your simplest shield against chaos. And learning How to Build an Emergency Fund is easier than you think. Let’s break it down.

Why Your Emergency Fund is Non-Negotiable

An emergency fund is cash reserved for true emergencies—think medical bills, job loss, or urgent repairs. It’s not for vacations or impulse buys. Here’s why it matters:

- Prevents debt spirals: Without savings, a $1,700 emergency often becomes credit card debt at 20 %+ interest.

- Reduces stress: People with $2,000+ saved report 21% higher financial well-being.

- Saves time: Those without savings spend 7.3 hours/week worrying about money vs. 3.7 hours for those with a cushion.

How Much Do You Need?

The golden rule is 3–6 months of living expenses. For the average U.S. household in 2025, that’s $35,218. But don’t panic—start smaller:

- Step 1: Aim for $500–$2,000 to cover minor crises (e.g., car repairs).

- Step 2: Scale up based on your risk:

- Freelancers or parents? Target 6–9 months.

- Stable job + low expenses? 3 months may suffice.

Example: Saving $20/week gets you $1,000 in a year.

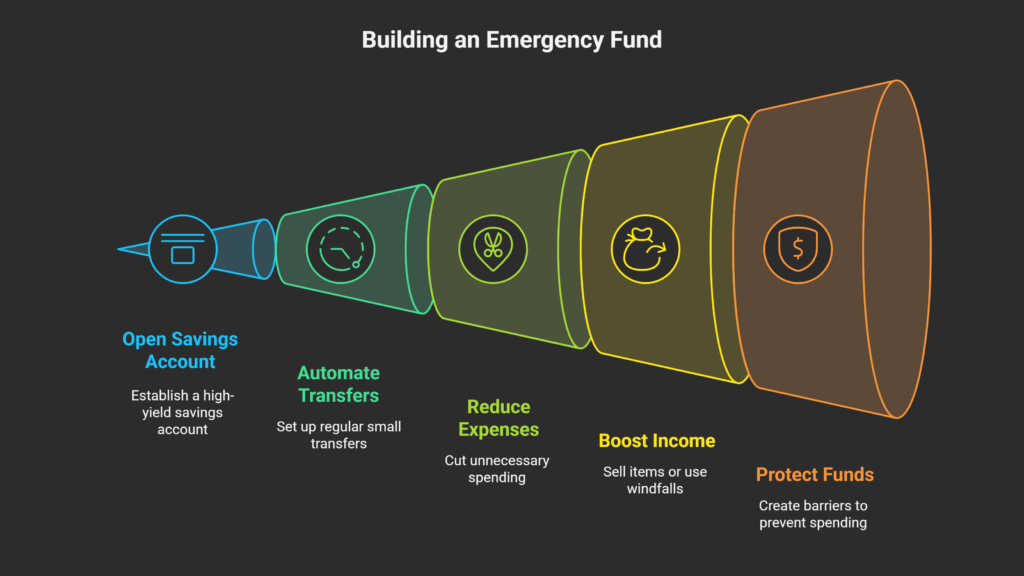

How to Build an Emergency Fund: Your Step-by-Step Blueprint

1. Assess and Set Your Target

Calculate essential monthly costs (rent, food, utilities, insurance). Multiply by your target months (e.g., $3,000/month × 3 = $9,000). Tools like NerdWallet’s Emergency Fund Calculator simplify this.

2. Start Small, But Start Now

- Open a separate high-yield savings account (aim for 4%+ APY). Online banks, such as Ally or Marcus, offer these.

- Automate transfers: Even $10 per week adds up to $520 per year.

3. Slash Expenses & Boost Income

- Trim subscriptions/dining out: Redirect savings to your fund.

- Sell unused items: Declutter for cash.

- Use windfalls: Allocate 50% of tax refunds/bonuses.

4. Make It Untouchable (Until It’s Not)

- Mental barrier: Label the account “DO NOT TOUCH—EMERGENCIES ONLY.”

- Access rules: Keep it liquid but not too convenient (e.g., at a different bank).

5. Rebuild After Use

Used funds for a true emergency? Prioritise replenishing. Set a timeline (“I’ll restore $1,000 in 4 months”).

How to Build an Emergency Fund Fast: Turbocharge Your Savings

When time is critical, these strategies accelerate progress:

1. Leverage Windfalls

- Tax refunds, bonuses, or gifts can seed your fund. 37% of Americans use these for savings.

2. Launch a Side Hustle

- Freelance, drive rideshares, or sell crafts. Earn an extra $200/week? That’s $2,400 in 3 months.

3. Radical Expense Cuts (Temporarily!)

- Try a 30-day “no-spend challenge” on non-essentials.

- Downgrade services (e.g., cheaper phone plan).

4. Employer Programs & “Side Car” Accounts

- Ask about split direct deposits (send part of your paycheck straight to savings).

- Some companies offer emergency savings accounts via SECURE 2.0, with tax-free withdrawals.

5. High-Yield Accounts: Let Your Money Work

Park cash in accounts earning 4 %+ APY. At that rate, $5,000 earns $200/year, risk-free.

Fast-Track Savings Comparison Table

| Strategy | Speed | Effort | Potential Savings Boost | Best For |

|---|---|---|---|---|

| Side Hustle | ★★★ | ★★★ | $500–$2,000/month | Freelancers |

| Windfall Allocation | ★★★★ | ★ | $1,000–$5,000 one-time | Tax season recipients |

| Expense Reduction | ★★ | ★★ | $200–$800/month | Budget-conscious |

| Employer Savings Plan | ★★★★ | ★ | Automated, consistent | 9-to-5 employees |

Where to Stash Your Emergency Fund

Safety + accessibility = key. Avoid stocks or retirement accounts (early withdrawal penalties!). Ideal options:

- High-yield savings accounts: Earn 4 %+ APY, FDIC-insured.

- Money market accounts: Similar returns, sometimes with check-writing.

- TFSAs (Canadians): Tax-free growth, flexible withdrawals.

Pro Tip: If you have a mortgage, use an offset account—it reduces interest while keeping funds accessible.

When to Use It (And When NOT To)

Real emergencies:

- Medical bills not covered by insurance

- Job loss

- Critical home/car repairs

Non-emergencies: - Vacations

- Black Friday deals

- Gifts

Replenish immediately after use!

The Ripple Effect: Why This Matters Beyond Money

A robust emergency fund isn’t just practical—it’s transformative. Vanguard found it slashes financial stress by 46%. It frees mental space, protects retirement savings, and even boosts workplace focus.

Start Today, Sleep Better Tonight

Building an emergency fund is a marathon, not a sprint. Celebrate small wins:

“Eva saved $20/week automatically. When her car broke down, she covered the $1,000 repair without debt—then restarted her savings habit.”

Your first $500 is a triumph. Your sixth month of expenses is freedom. Begin now, automate, and watch resilience grow. Because life’s surprises shouldn’t dictate your future, your savings should.

Got a windfall or a savings tip? Share your story in the comments!

How much should I save in my emergency fund?

Start with $500–$2,000 for small crises, then build toward 3–6 months’ essential expenses (rent, food, utilities). Use our Emergency Fund Calculator to personalise your target.

Where’s the safest place to keep my emergency fund?

Prioritise accessibility + growth. Use a high-yield savings account (4 %+ APY) at a separate bank, FDIC-insured and with penalty-free withdrawals. Avoid stocks or retirement accounts

What counts as a real emergency?

Only unexpected, essential costs: job loss, urgent medical bills, critical car/house repairs. Not vacations, gifts, or sales. Replenish immediately after use!

How can I build an emergency fund fast?

Turbocharge savings with:

→ Windfalls (tax refunds/bonuses)

→ A side hustle (e.g., freelancing)

→ Radical cuts (30-day no-spend challenge)

(See our Fast-Track Comparison Table!)Is it worth the effort if I’m debt-heavy?

Yes! Start micro-saving ($10/week) while paying down debt. Even $500 prevents new high-interest debt when small emergencies hit.

What if I keep dipping into my fund?

Automate transfers to a separate bank, label it “DO NOT TOUCH,” and define your “emergency rules” upfront. Consistency > perfection!