Why the Wealth Gap Is Growing — And How a Common Man Can Break Free

In an increasingly connected world, where opportunity seems boundless, a stubborn economic reality continues to shape lives: the growing wealth gap. While we scroll through success stories and financial advice reels, the truth is—many people are struggling to build basic security. So what is this gap, why is it widening, and how can the average person take control and forge a better financial future?

Let’s unpack it together.

What Is Wealth Gap?

The wealth gap refers to the stark disparity in the distribution of assets, income, and financial resources between the richest and the poorest. It’s not just about salary differences—it’s about who owns what.

Imagine a pie representing all the wealth in a country. Instead of everyone getting a fair slice, a small fraction of the population owns most of it—property, investments, and savings, while the majority scramble for crumbs. This gap shapes opportunities, determines access to services, and ultimately affects life quality Investopedia.

This inequality is especially visible in asset ownership: wealthy households typically generate more wealth from what they already own, while middle- and lower-income families rely heavily on wages.

Wealth Gap Is Growing

The wealth gap is growing, and this is no longer a debatable point. According to Statista, the richest 10% hold more than 76% of global wealth. Meanwhile, most working-class individuals find it harder to save, invest, or plan for retirement.

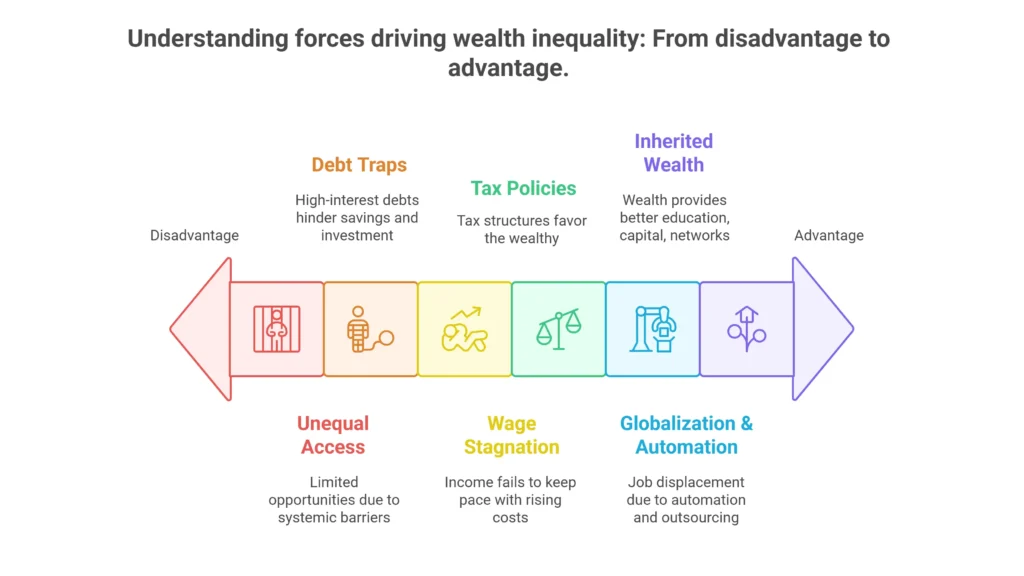

Why is the gap expanding? Multiple forces are at play:

- Unequal Access to Education & Healthcare: Quality education and healthcare are expensive. Without them, opportunities remain limited RBC Royal Bank.

- Systemic Discrimination: Racial, gender, and socioeconomic discrimination still block access to wealth-building tools.

- Debt Traps: High-interest debts (especially student and credit card debt) prevent savings.

- Wage Stagnation: Incomes haven’t kept up with rising living costs.

- Inherited Wealth: Those born into wealth get a head start—access to better education, capital, and networks.

- Globalization & Automation: Many low- and middle-skill jobs have vanished, replaced by machines or outsourced abroad.

- Tax Policies: In some economies, tax structures favor the rich—especially through capital gains and inheritance tax loopholes.

Real-World Comparison: How Wealth Accumulates

| Factor | Common Man’s Path | Wealthy Individual’s Path |

| Income Source | Wages | Business, investments, inheritance |

| Savings Approach | After essential expenses | Automated investing, long-term growth strategy |

| Debt Profile | Consumer debt | Productive debt (e.g., real estate) |

| Access to Capital | Limited, bank loans | Access to venture capital, family funds |

| Financial Knowledge | Often self-taught | Professional advice from an early age |

| Risk Tolerance | Low (due to insecurity) | Higher (with safety nets in place) |

This table shows how systemic advantages make wealth-building dramatically easier for the already wealthy.

How Can the Wealth Gap Be Fixed?

Solving the wealth gap requires both system-level changes and individual strategies. Economists and institutions like the Peterson Institute, World Economic Forum, and United Nations suggest:

- Progressive Taxation: Higher taxes on the ultra-wealthy can help fund public services.

- Universal Access to Education: Affordable education opens doors for upward mobility.

- Social Safety Nets: Benefits like healthcare, childcare, and housing assistance reduce economic risk.

- Labor Rights & Fair Wages: Protecting workers and enforcing living wages ensure shared prosperity.

- Regulated Markets: Controlling speculation and financial risk protects vulnerable groups.

- Anti-Discrimination Measures: Equal access to jobs, loans, and housing is fundamental.

But these changes take time.

What Can the Common Man Do?

While waiting for policy changes, individuals can still take bold, practical steps to improve their financial position.

1. Develop Marketable Skills

Keep upgrading your skills—especially those in demand like tech, healthcare, design, and trades. Platforms like Coursera and edX offer certifications that employers respect.

2. Pursue Financial Education

Books like Your Money or Your Life and The Simple Path to Wealth break down financial literacy in easy terms. Follow trusted websites like Investopedia or financial YouTubers for regular insights.

3. Start Investing Early

You don’t need a lot to start. Apps and robo-advisors now allow you to invest as little as $5. The key? Start now. Compounding works better the longer it runs.

4. Eliminate High-Interest Debt

Pay off credit cards and personal loans aggressively. Use either the snowball method (smallest debt first) or the avalanche method (highest interest first).

5. Create and Stick to a Budget

Track your expenses. Categorise them. Spot leaks. Apps like YNAB or even Google Sheets can help.

6. Build an Emergency Fund

Aim for 3–6 months of expenses. This cushion reduces panic during emergencies and keeps you out of predatory lending cycles.

7. Leverage Employer Benefits

From retirement plans to stock options—don’t leave free money on the table. Understand and use all available perks.

8. Seek Certifications & Higher Education

Specialized diplomas and certifications can offer great ROI. Think project management, data analysis, UX design, etc.

9. Use Financial Tools & Tech

Track net worth, identify hidden fees, and analyze investments with platforms like Personal Capital.

Real Life Impact: Why This Works

When people consistently apply these steps, they report:

- Better financial control

- Less stress and money-related conflict

- Higher savings and investments

- Confidence to leave toxic work environments

- Hope for future generations

Many individuals also pursue FIRE (Financial Independence, Retire Early), proving that long-term planning—even on modest income—can radically improve life outcomes.

Tips to Implement These Changes

Getting started is often the hardest part. Here’s a cheat sheet:

- Start Small: Save Rs. 500 or $10 a week—just begin.

- Automate Everything: Make saving and investing automatic.

- Avoid Lifestyle Inflation: Don’t upgrade just because income increased.

- Join Supportive Communities: Subreddits like r/personalfinance or FIRE Facebook groups can be very motivating.

- Stay Consistent: You don’t need perfection—just persistence.

Final Thoughts

Yes, the wealth gap is massive and growing—but you are not powerless. You may not dismantle the system alone, but you can take control of your corner of it.

With the right knowledge, tools, and habits, the common man can rise—not to become the 1%, but to build freedom, peace of mind, and a secure future.

Resources to Bookmark

- Understanding the Wealth Gap – RBC

- Seven Ways to Reduce Inequality – Corporate Knights

- FIRE Journey – LinkedIn Pulse

- Debt and Credit Reports – NY Fed

- UN Chronicle on Wealth Disparities